Strategize Your Debt With a Plan

You can get out of debt! However, it’s going to require a strategy. Here is what you need to do.

List Our Your Debt

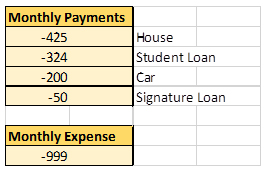

The first thing you want to do is list out your debts according to payment. You can add the total balance if you’d like, but the point of this exercise is payment based.

Arrange and list them according to the payment amount (as opposed to the payoff amount), with the highest payment at the top and the lowest payment at the bottom (as shown below). For this example, I am using a house payment, a student loan payment, a car payment, and a signature loan payment. However, you will need to list ANY and ALL debt-based payments.

NOTE: You would NOT want to include things like trash, electricity, cable, etc. (recurring payments) because these will exist as long as you have the service and are not considered “debt-based.”

The Budget

Total up the monthly expense and see if you can really afford it. You will see that the bills in this example total $999.00 a month. If I found that I could not afford it but had services such as cable, Netflix, and a gym membership, or after considering my repeat visits to a bar or restaurant, then I would need to reevaluate and determine which sacrifices I am willing to make to meet my monthly obligations. This part is critical.

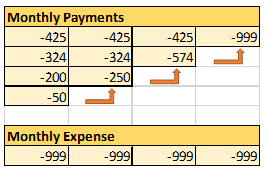

The total amount ($999.00 in this exercise) is the amount that you will be spending THROUGHOUT the program. If you discipline yourself to stay with this program, you will be thanking yourself and me before you know it.

The Process

Step One: Make your monthly payments as usual.

Step Two: Throw ANY extra money you can at the principle of the lowest bill. In this scenario, we are attacking the $50 monthly bill. Whether you have an extra $100 or $5, you should always throw it at this bill by paying extra. So instead of $50, it would be $55 or $150. Take Christmas or birthday money and put it towards it until it’s paid off. The faster you do this, the faster this plan will work for you.

Step Three: Once the first bill is out of the way, you can keep your extra cash, but otherwise, you would keep your budget the same. So instead of pocketing that spare $50, you put it towards the next largest bill instead.

Step Four: Follow the chart accordingly. Always take the money towards the previous bill and apply it to the next. Not only will you be out of debt in almost half the time, but you will also save a ton in interest that you would otherwise be paying. Once the bills are paid off – enjoy the extra cash or do something wise like invest, buy metal, or save it.

Step Five: Refinance your credit if necessary

Keep learning! Check out my article titled, “Saving Money – Save over $1300 the Easy Way.”

See Financial/Legal/Tax Disclaimer